GoodBarber's Online Help

Management of reduced VAT or taxes rate by products

If you sell books and beer from your shopping app, the tax rate applied is probably not the same for all your products.

Activate the option Tax rate management by product to set different tax rates by product.

For this go to the menu Settings > Taxes > Tax rate management by product

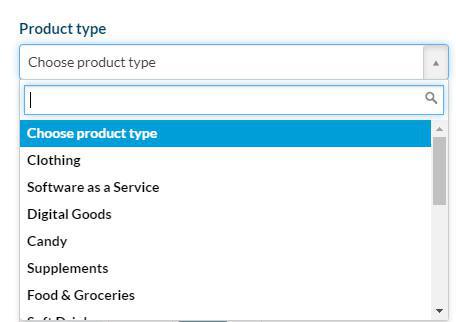

In each product page of your back office, a new drop down menu is available in the right panel.

USA - Canada (Taxjar)

Taxjar calculates automatically the tax rate of your product depending on the product type selected (ex: clothing, food & groceries, etc.)

Select the type of product from the drop down menu in the right panel.

Rest of the world

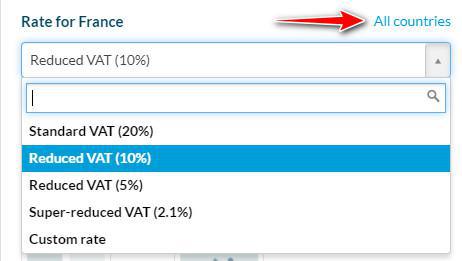

If your shop is based elsewhere than in the USA or Canada, the drop down menu will display tax rates known for your shop's country.

Otherwise, you can set your own rates. The drop down menu is displayed in the right panel of each product page.

Select the tax rate for the country where your shop is based, depending on the type of product.

If you ship products to several countries, remember to set the rate for all countries where you ship your products.

In this example, the shop is based in France and ships to Italy, Spain and Jordan.

Note:

- If you don't fill in the tax rates for other countries, the default tax rates used will be provided by Taxjar .

- You can also set different shipping fee taxes .

Design

Design