GoodBarber's Online Help

Discount calculation

Discounts can be triggered from a minimum (and/or maximum) order amount.

Please note that the control is only done on the products amount and does not take the delivery fees into account.

If your shop displays prices all taxes included

The control is done on the amount of the order all tax. incl. Therefore, the tax amount may vary after discount.

Example:

- $10 discount on a $100 purchase

- 3 items at $33 each and 1 item at $3, for a total amount of $102

- 20% tax on all the items

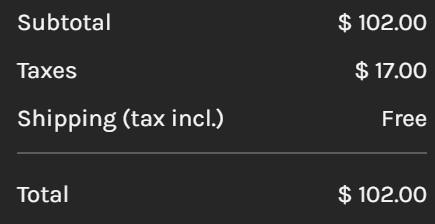

Calculation of the price and taxes without the discount:

Calculation of the price before tax: $102 x 100 / (100+20) = $85

Price before tax $85 + $17 tax = $102 all tax. incl.

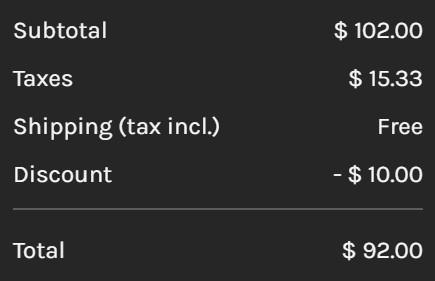

Since the order amount is $102, the order is eligible for the $10 discount.

Price $102 - $10 discount = $92

Calculation of the discounted price before tax: $92 x 100 / (100+20) = $76,67

Price before tax $76,67 + $15,33 tax = $92 all tax. incl.

Note: although the amount paid is $92, the discount has been applied, since the price was originally $102.

If your shop displays prices without including taxes

The control is done on the order amount before tax.

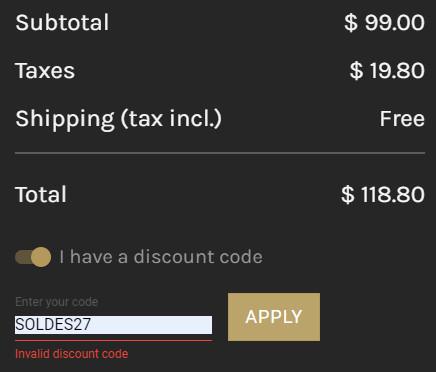

Example :

- $10 discount from $100 purchase

- 3 products at $33 each for a total of $99

- 20% tax on all products

The control is done on the order amount before tax.

In this case, although the total price is $118.80, the amount before tax does not reach $100 for the discount to be applied.

The discount code is therefore invalid.

Design

Design