GoodBarber's Online Help

iOS - Set your Agreement, Tax and Banking information on App Store Connect

Prerequisite: A valid Apple Developer Account

In order to be able to set your Agreement, Tax and Banking information on App Store Connect, you first need to make sure your Apple Developer account is up and running.

If you haven't yet created your Apple Developer account, this online help describes the process you must follow.

To renew an expired Apple Developer Account, the current account holder must connect to https://developer.apple.com/account/ and follow Apple's instructions.

Once your Apple Developer Account is valid, you should be able to set your Agreement, Tax and Banking information on App Store Connect as described in the next paragraphs.

Note : Only the account holder of the Apple Developer account has the ability to set the Agreement, Tax and Banking information in App Store Connect.

View and agree to the terms of the Paid App Agreement

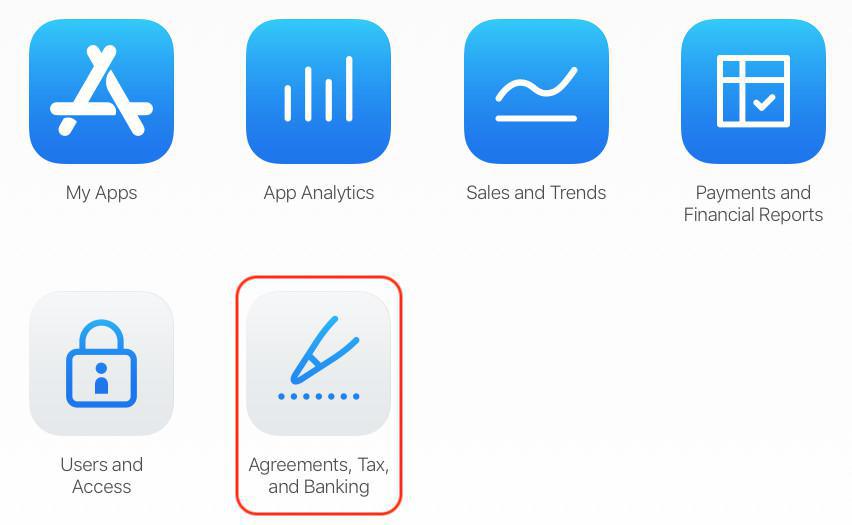

In the Agreement, Tax and Banking menu in your App Store Connect account, you should see at least 2 types of agreements:

- Free Apps, which is active by default

- Paid Apps, which requires to be set up. Click the link "View and Agree to Terms" to access the next step.

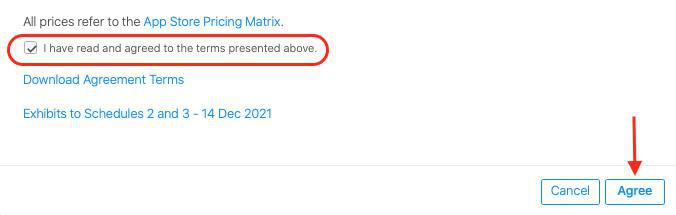

1 - Review the Paid Applications Agreement

2 - Tick the box stating you have read and agreed to the terms

3 - Click the button "Agree".

Set Up Tax and Banking

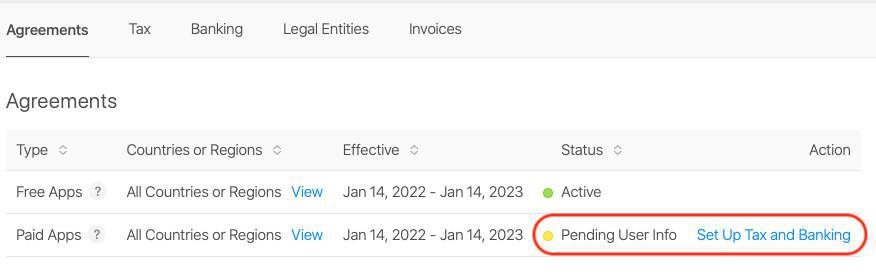

In the Agreement, Tax and Banking menu, the status for the Paid Apps Agreement has now changed to "Pending user info".

Click the blue link "Set Up Tax and Banking".

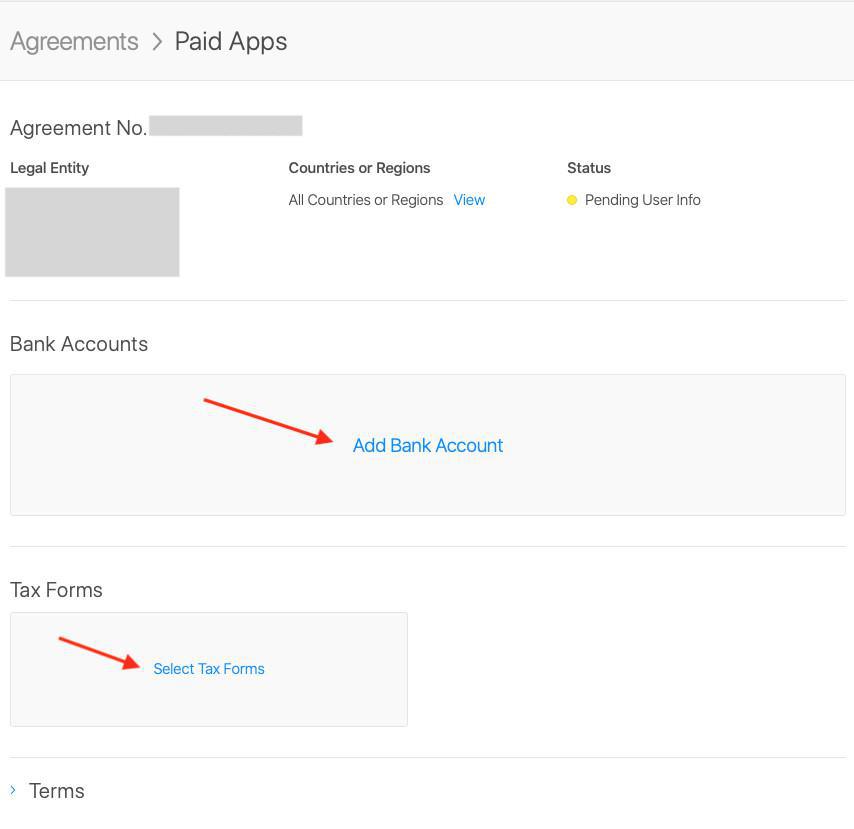

On the next page, you will be able to register your bank account information and the information regarding tax forms.

New Bank Account

1 - Provide the information requested by Apple regarding your bank account information.

2 - Tick the box at the bottom of the page stating that you have read and agreed to the statement presented above.

3 - Save.

Tax Forms

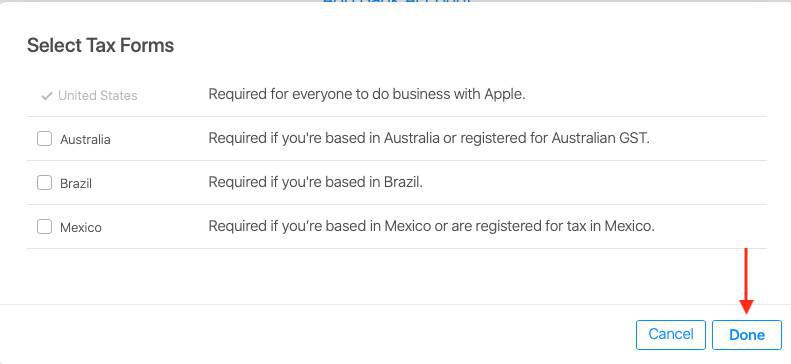

Click the Tax Forms box to edit the information.

The tax form for the United States is selected by default.

If you are based in Australia, Brazil or Mexico, tick the appropriate box.

If you are based anywhere else in the world, leave the form as it is and click Done.

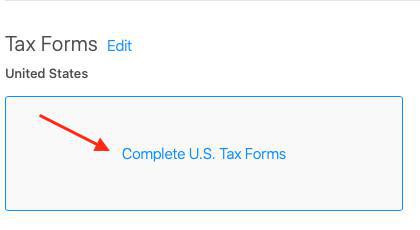

Complete U.S. Tax Forms

The box now displays the mention "Complete U.S. Tax Forms".

Click the box again and answer Apple's questions until you get to a form.

The content of the form will depend on your answers to the previous questions.

Complete the form with the accurate information and submit it using the button at the top right.

In case you made a mistake in the U.S. Tax Forms process, it is still possible to go back as long as you haven't submitted the final form. Once the form has been submitted, you will have to contact Apple in order to edit your information.

Note : Instructions may differ if you selected Australia, Brazil or Mexico at the previous step. In any case, provide Apple with the information they request and submit the requested form(s).

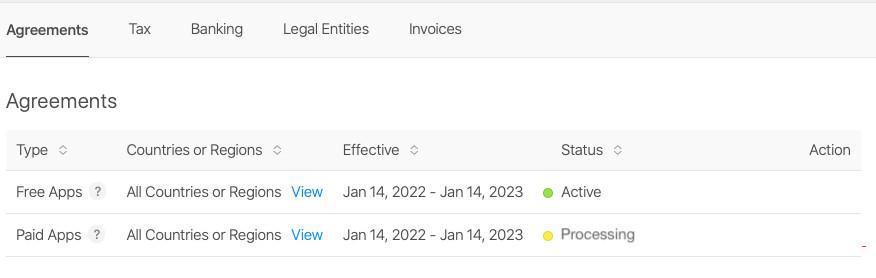

Agreement status: Processing

Go back to the Agreement, Tax and Banking menu.

The status of the Paid Apps agreement should now have changed to "Processing".

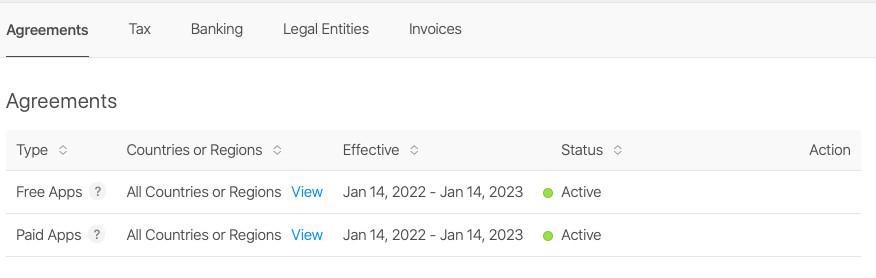

Agreement status: Active

From then on, all you have to do is wait for the status to change again to "Active". It may take a few hours to happen.

Once this is done, your App Store Connect account is set to configure subscriptions.

- Android - Set your payment profile and method in Google Play

- Android - Set memberships for a new Android app

- Android - Create or edit a subscription in Google Play (Solo process)

- Android - Publish a new Android app with memberships in Google Play (Solo process)

- Android - Promote the .aab file from Internal Testing to Production in Google Play

- iOS - Set your Agreement, Tax and Banking information on App Store Connect

- iOS - Set memberships for a new iOS app (GoodBarber Takes Care)

- iOS - Set / Edit subscriptions in App Store Connect (Solo process)

- Test your memberships on iOS and Android

- Create promotion for your memberships

Design

Design